The Ultimate Guide to Forex Trading Brokers

In the realm of Forex trading, the choice of broker can significantly influence your trading experience. This guide will provide valuable insights into the role of Forex trading brokers, offer tips on how to choose the best one, and discuss the potential impact of brokers on your forex trading success. For an extensive overview of trading platforms and user experiences, visit trading brokers forex https://tradingplatform-hk.com/.

What Are Forex Trading Brokers?

Forex trading brokers are financial services firms that provide access to the foreign exchange market. They serve as intermediaries between traders and the global currencies market. Brokers offer various services including access to trading platforms, market analysis tools, and educational resources to help traders make informed decisions. They can be categorized into several types, including market makers, STP (Straight Through Processing), and ECN (Electronic Communication Network) brokers.

Types of Forex Trading Brokers

1. Market Makers

Market makers are brokers who create a market for traders by providing liquidity. They quote both buy and sell prices, thereby allowing traders to make trades at those prices. The main advantage of market makers is their ability to provide quick execution and trade availability. However, they often make a profit from the spread, which may not be to the advantage of the trader.

2. STP Brokers

STP brokers route orders directly to liquidity providers. This means that traders get the best possible prices from the market. STP brokers charge a small commission for their services, but they provide better pricing and a more transparent trading environment. They also eliminate the conflict of interest since they do not trade against their clients.

3. ECN Brokers

ECN brokers connect traders directly to the interbank market, allowing them to trade directly with other market participants. This type of broker typically charges a commission per trade but offers very tight spreads. ECN brokers are known for their transparent order execution and excellent trading conditions, making them a popular choice among professional traders.

Choosing the Right Forex Broker

Selecting the right Forex broker is critical for your trading success. There are several factors to consider when making this decision:

1. Regulation and Trustworthiness

Ensure that the broker you choose is regulated by a reputable authority. Regulations help protect traders from fraud and ensure a certain standard of operation. Regulatory bodies like the Financial Conduct Authority (FCA), the CySEC (Cyprus Securities and Exchange Commission), and the NFA (National Futures Association) are well-regarded in the industry.

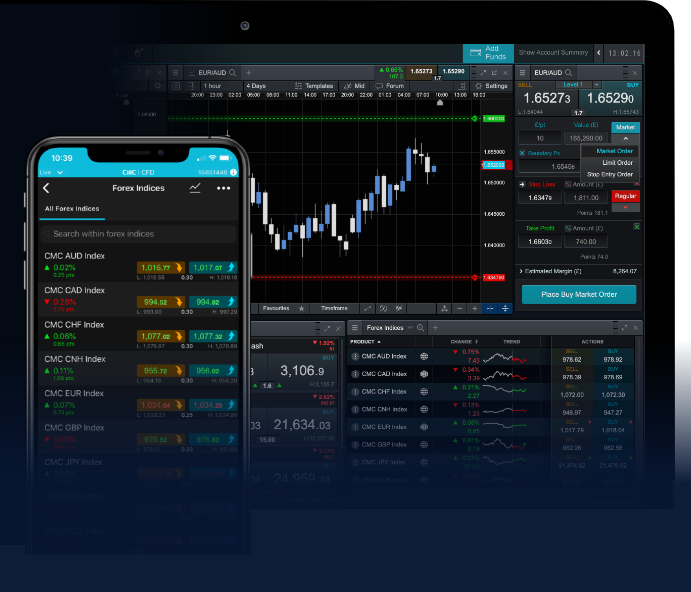

2. Trading Platform

The trading platform is your gateway to the Forex market. Look for brokers that offer user-friendly, reliable, and feature-rich platforms such as MetaTrader 4 or 5. Your choice of platform can affect your trading performance, so test demo versions before committing to a live account.

3. Spread and Commissions

Different brokers offer various spreads and commission structures. Pay attention to the cost of trading as it can eat into your profits. Generally, ECN brokers have lower spreads but charge a commission, while market maker brokers might have higher spreads but no commissions.

4. Customer Support

Reliable customer support is essential for resolving issues that may arise during trading. Look for brokers that provide multiple channels of communication such as live chat, email, and phone support. Check reviews to gauge the quality of their customer service.

5. Educational Resources

Many brokers offer educational materials and resources for new traders. Look for brokers that provide webinars, tutorials, and analysis tools that can aid your trading journey. Continuous learning is crucial in the fast-paced Forex market.

The Impact of Brokers on Your Trading Strategy

Your broker can have a significant impact on your trading strategy. Here’s how:

1. Execution Speed

Execution speed can be critical in Forex trading, especially for scalpers who rely on quick trades to capitalize on minor price movements. The quality of brokerage services can affect how fast your orders are executed, which can mean the difference between a profit and a loss.

2. Slippage

Slippage occurs when a trade is executed at a different price than expected. While slippage is common in volatile markets, some brokers may have policies or systems in place to minimize its impact. Understanding your broker’s slippage policies can help mitigate associated risks.

3. Access to Research Tools

Some brokers provide extensive research tools that can be invaluable for building and refining trading strategies. Look for brokers that offer technical analysis, market news, and recommendations, as these resources can help inform your trading decisions.

Conclusion

In summary, selecting the right Forex trading broker is a crucial step that can dramatically influence your trading success. By understanding the types of brokers available and evaluating them based on regulation, trading platforms, costs, and support, you can make an informed decision that fits your trading style and objectives. With the right broker, you’ll be better equipped to navigate the complexities of the Forex market effectively.

Remember, successful trading requires not just a reliable broker but also a solid trading strategy and continuous education. Stay informed, remain adaptable, and keep honing your skills to thrive in the exciting world of Forex trading.