Effective Forex Trading Strategies for Small Traders

Forex trading can be both exciting and profitable, especially for small traders who are looking to make their mark in the financial markets. With the right strategies, even individuals with limited capital can effectively participate in forex trading, capitalize on market movements, and achieve financial independence. Before diving into the strategies, it is crucial to understand the dynamics of forex trading and how proper planning can lead to success. For those interested in trading in India, you might want to check out forex trading strategies for small accounts Trading Brokers in India for guidance on finding reliable forex brokerage services.

Understanding Forex Trading

The foreign exchange market, commonly known as forex, operates around the clock and involves the trading of currencies. Unlike traditional stock markets, forex trading is characterized by its high liquidity and significant volatility. These features can be advantageous for small traders who often seek quick transactions and can take advantage of small price fluctuations.

Why Forex Trading is Suitable for Small Traders

Forex trading can be particularly appealing to small traders due to factors such as:

- Low Capital Requirements: Many forex brokers allow trading with a small initial deposit. This accessibility encourages new traders to enter the market.

- Leverage: Forex trading often involves the use of leverage, enabling traders to control larger positions than their actual capital would allow. This amplifies potential gains, although it also increases risk.

- Diverse Opportunities: The forex market provides a plethora of trading pairs, giving small traders various opportunities to diversify their portfolios.

- Accessibility: With advancements in technology, forex trading can be conducted easily from anywhere in the world using a smartphone or computer.

Key Strategies for Small Traders

Now that we have established the basics of forex trading, let’s delve into specific strategies that can help small traders succeed:

1. Develop a Trading Plan

Every successful trader must have a well-defined trading plan. This plan should outline trading goals, risk tolerance, and entry and exit strategies. A solid trading plan will help you stay disciplined and avoid emotional trading decisions.

2. Start with Demo Trading

Before risking real money, small traders should consider practicing on a demo account. Most brokers offer this feature, allowing traders to familiarize themselves with the trading platform and test their strategies without financial risk.

3. Focus on a Few Currency Pairs

Small traders may find it beneficial to focus on a limited number of currency pairs. This allows for deeper research and understanding of the market movements of those specific currencies, resulting in more informed trading decisions.

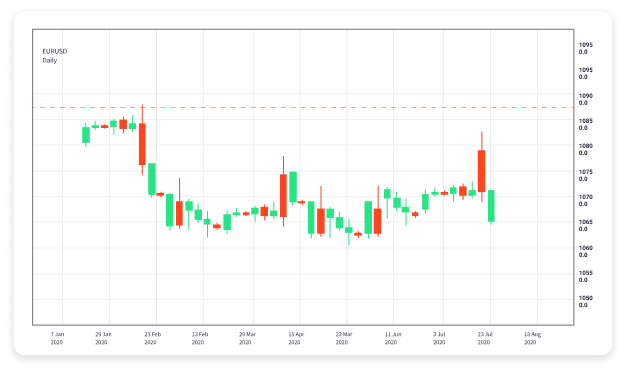

4. Utilize Technical Analysis

Technical analysis involves using historical price data to predict future movements. Learning to read charts and understand indicators such as moving averages, RSI, and MACD can significantly enhance trading strategies.

5. Implement Risk Management Techniques

Proper risk management is essential for long-term success in forex trading. Small traders should never risk more than a small percentage of their trading capital on a single trade. Tools such as stop-loss orders can help protect your account from substantial losses.

6. Stay Informed and Educated

The forex market is influenced by a range of economic factors, political events, and market sentiment. Small traders should stay updated with global news, economic reports, and market analyses to make informed trading decisions.

7. Be Mindful of Trading Psychology

Maintaining a disciplined mindset is crucial for forex trading success. Small traders often face emotional challenges such as fear and greed. It’s essential to understand these emotions and develop strategies to manage them effectively.

Adapting to Market Changes

The forex market is constantly evolving, and successful traders must be agile and ready to adapt their strategies to changing market conditions. Continuous learning and flexibility are key components of a thriving trading career.

Final Thoughts

Forex trading holds immense potential for small traders willing to invest time in learning and honing their skills. By implementing effective trading strategies based on sound principles, these traders can navigate the complexities of the forex market and work towards achieving their financial goals.

In summary, combining a solid trading plan, sound risk management, continuous education, and an understanding of market dynamics will position small traders for success in forex trading. With patience and diligence, any small trader can potentially turn forex trading into a profitable venture.